01/

As we enter 2026, markets are transitioning into a materially different regime—higher-for-longer rates, persistent policy/geopolitical uncertainty, and a more balanced global opportunity set. In this environment, portfolio construction may need renewed emphasis on diversification, quality, and inflation-resilience within a 40/30/30 framework.

02/

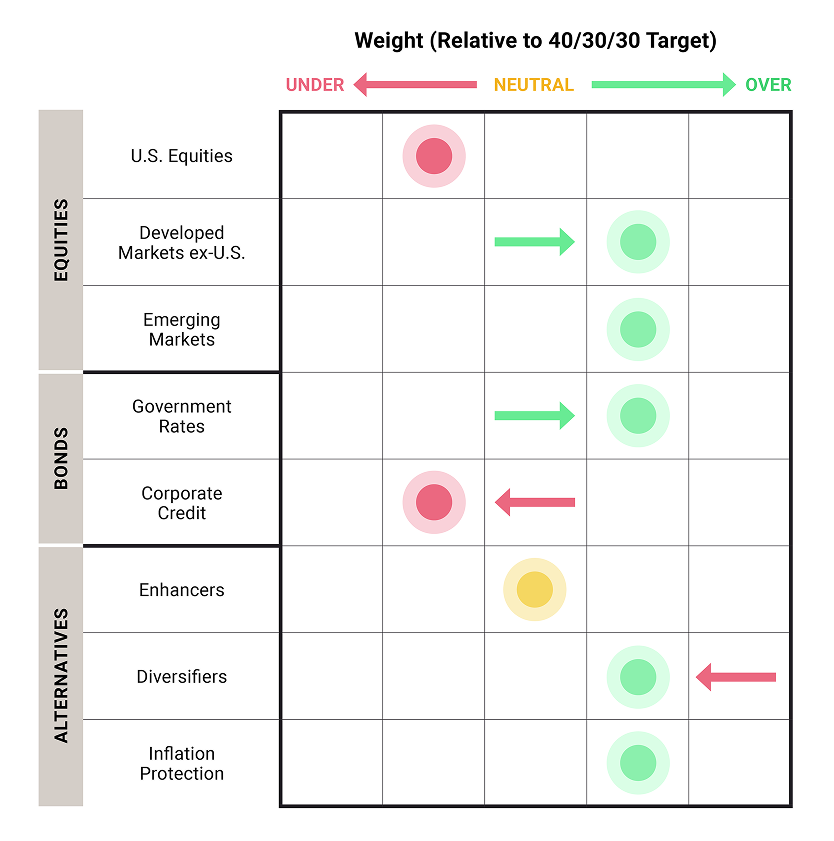

We remain neutral equities but with a clear tilt to non-U.S. markets, where valuations are more compelling and policy backdrops appear better positioned—while staying cautious on rich U.S. large-cap valuations. In fixed income, we remain neutral to modest overweight high-quality duration, and prefer higher-quality credit given that broader credit looks expensive with risks building in more speculative segments.

03/

With sticky inflation risks and ongoing monetary debasement, we’re overweight alternatives—including inflation-linked assets, market-neutral strategies, real assets expressed primarily as commodities —aiming to add true diversification, smooth returns, and mitigate against inflation risks. Within alternatives, we continue to emphasize Diversifiers over Enhancers to reduce overall portfolio beta, especially in a world where 60/40 diversification may be less reliable.

Positioning for an Inflection Point: Stay Diversified and Look Broadly at Return Streams

Big Picture: What We See Ahead As we enter 2026, the investment landscape is transitioning into a materially different regime than the one that defined much of the past decade, reaching a critical inflection point. After a year marked by policy uncertainty, uneven disinflation, and divergent regional growth, markets now face a world where interest rates remain higher than in the past decade, technological disruption accelerates, and geopolitical dynamics continue to reshape trade and capital flows.

While the U.S. economy shows signs of cooling from an extended period of resilience, non-U.S. developed markets and select emerging economies are gaining relative momentum, creating a more balanced global opportunity set. Against this backdrop, asset allocation in 2026 will likely require renewed emphasis on diversification, quality, and inflation-resilience, with alternatives and real assets (i.e. commodities) potentially playing a more prominent role.

Base Case: Rocky Start to The Year Lifted by Stimulus into Mid-year

Near-term market strain is expected as the labor market cools and consumer resilience wanes, weighing particularly on segments of the equity market with more questionable valuations (and the riskier segments of credit). This period is anticipated to persist until the full effects of the Fiscal Dominance regime become undeniable, likely accelerating closer to mid-year as a new Fed chair of Trump’s choosing takes the helm of the Federal Open Market Committee (FOMC).

The upside risk from substantial fiscal stimulus, specifically the One Big Beautiful Bill Act, which is expected to dramatically impact the real economy, remains a key catalyst at some point this year. As this policy trajectory confirms the path of financial repression, precious metals and key industrial commodities could see significant upward repricing, positioning them strongly for the second half of 2026.

Strategic Principles (for 2026 & Beyond)

Diversification over concentration: avoid single-asset dependency; maintain balance across equities, fixed income, and alternatives.

Quality and real assets: in a world of policy uncertainty and inflation risk, favor quality credit, duration when valuations allow, and real-asset inflation hedges.

Global diversification could matter more than ever: diminished U.S. exceptionalism coupled with global growth divergence could demand broader geographic exposure.

In terms of our positioning, weightings are discussed relative to a broad 40/30/30 target allocation of equities/fixed income/alternatives based on our belief that this asset allocation mix is a better way to help build portfolios that can deliver greater certainty.

Equities: Neutral, with a tilt toward non-U.S. markets

Under our 2026 base case, global equities remain a core return driver as leadership broadens beyond the U.S. tech heavyweights, and growth momentum improves in non-U.S. developed markets and select emerging economies. U.S. large-caps remain supported by earnings durability and AI-driven productivity, yet rich valuations argue for a cautious stance. Relative opportunities are expected to be stronger abroad, where valuations can be more compelling and monetary policy may be better positioned.

Fixed Income: Neutral to modest overweight in high-quality duration

We expect interest rates to remain higher for longer in the U.S., but with inflation trending gradually toward target elsewhere, high-quality sovereign bonds could offer improved defensive characteristics and attractive real yields.

Credit remains broadly overvalued and expensive. We favor higher-quality segments as risks are slowly building in the more speculative segments.

Alternatives: Overweight for Diversification and Inflation Resilience

Given persistent policy uncertainty and geopolitical risk, the potential for sticky inflation risks to breed upside inflation surprises, as well as ongoing monetary debasement, alternatives will likely play an outsized role in 2026 portfolio construction.

In a world tilting towards stagflation, 60/40 fails as a diversification scheme because of changing stock/bond correlations. Alternative assets such as commodities are likely a focus in order to realize 2026’s key investment themes, in addition to alternative strategies that can capture the active alpha linked to asymmetric returns resulting from the “K-shaped” economy (while hedging our near-term risks to frothy sectors).

We’re overweight inflation-linked assets and market-neutral strategies, as these exposures aim to provide true diversification and corresponding return smoothing, while mitigating against ongoing market volatility and inflation surprises.

We continue to emphasize alternatives as key diversifiers, including strategies with inflation-sensitive returns. Within our Inflation strategy, Precious Metals have trended higher and the strategy maintained a full position weight for most of 2025 as well as heading into 2026. The “debasement trade”, in which long term investors migrate away from traditional developed market government bond holdings and into hard assets, has resulted in near-historic price moves higher across most precious metals and more recently a catchup across many base metals now as well. Across other commodity groups, such as Energy and Industrial Metals, price movements have been oscillating and range bound, resulting in some noisiness in trend signals. These range-bound moves are perhaps the precursor to larger trends once economic data moves decisively towards reacceleration or not. Industrial Metals are at the confluence of different forces, notably the underlying economic growth data as well as potential participation in the debasement trade mentioned above. The inflation strategy continues to mirror underlying dynamics in the inflation markets and therefore aligns with the investment objectives of the strategy.

Within the Alternatives, we believe holding more exposure in Diversifiers than Enhancers can help reduce the beta of the overall portfolio to traditional Equity or Fixed Income risks.

Key Risks & What to Watch in 2026

US growth disappoints: Repeated policy shocks, renewed tariffs and trade wars, and/or sluggish consumer demand could weight on growth and risk assets.

Sticky inflation or policy mistake: If core inflation remains elevated, central banks may hold rates higher, potentially pressuring equities and credit.

Valuation resets: Concentrated equity valuations, especially in AI/big-tech, could create sharp drawdowns if growth disappoints or competition intensifies.

Liquidity or volatility shocks: With yield curve volatility and geopolitical uncertainty, liquidity events could hurt credit and risk assets.

It Pays to Take a Broader View of Diversified Return Streams

We remain focused on adding uncorrelated return streams to address potential risks to equity and credit markets:

Beta exposure to US equities is risky given the potential for a reversal in the mega cap names that have driven the majority of index returns over the last few years.

Non-US markets provide better risk/return potential as more reasonable valuations and clearer monetary policy should continue to support other developed and emerging markets.

Credit markets have limited upside due to lingering inflation concerns that might hinder the ability to engage in a full cutting cycle.

Uncorrelated return drivers like alternatives and commodities can act as a key diversifier to help manage the risks associated with a stagflationary environment.

Looking at the portfolio as a whole advisors should be reassessing asset allocation with a preference towards more diversification, higher quality and risk assets that can benefit from persistent inflation.

A Question for Advisors

If 2026 marks an inflection point for equity and credit markets, does your asset allocation offer true diversification that can weather the risk associated with stagflation, slowing growth and a valuation reset?

As of December 31, 2025 (%) | 1M | 3M | 6M | 1YR | 3YR* | 5YR* | 10YR* | Since Inception* | Inception Date |

PICTON Balanced Fund (F) | -0.82 | 0.80 | 5.41 | 12.83 | 12.48 | 7.75 | 8.17 | 8.05 | (2015-10-29) |

PICTON Multi-Strategy Alternative Fund (F) | 0.60 | 2.79 | 8.20 | 15.55 | 9.54 | 6.61 | — | 6.45 | (2018-09-27) |

PICTON Inflation Opportunities Alternative Fund (F) | 1.02 | 3.58 | 7.51 | 9.87 | — | — | — | 7.31 | (2023-05-04) |

(*) Annualized performance.

Source: Picton Mahoney Asset Management

This material has been published by PICTON Investments as at January 12, 2026. It is provided as a general source of information, is subject to change without notification and should not be construed as investment advice. This material should not be relied upon for any investment decision and is not a recommendation, solicitation or offering of any security in any jurisdiction. The information contained in this material has been obtained from sources believed reliable, however, the accuracy and/or completeness of the information is not guaranteed by PICTON Investments, nor does PICTON Investments assume any responsibility or liability whatsoever. All investments involve risk and may lose value. This information is not intended to provide financial, investment, tax, legal or accounting advice specific to any person, and should not be relied upon in that regard. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional.

This material may contain “forward-looking information” that is not purely historical in nature. These forward-looking statements are based upon the reasonable beliefs of PICTON Investments as of the date they are made. PICTON Investments assumes no duty, and does not undertake, to update any forward-looking statement. Forward-looking statements are not guarantees of future performance, are subject to numerous assumptions and involve inherent risks and uncertainties about general economic factors which change over time. There is no guarantee that any forward-looking statements will come to pass. We caution you not to place undue reliance on these statements, as a number of important factors could cause actual events or results to differ materially from those expressed or implied in any forward-looking statement made.

Commissions, trailing commissions, management fees, performance fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Alternative mutual funds can only be purchased through a registered dealer and are available only in those jurisdictions where they may be lawfully offered for sale.

There is no guarantee that a hedging strategy will be effective or achieve its intended effect. The use of derivatives or short selling carries several risks which may restrict a strategy in realizing its profits, limiting its losses, or, which cause a strategy to realize or magnify losses. There may be additional costs and expenses associated with the use of derivatives and short selling in a hedging strategy.

This material is confidential and is intended for use by accredited investors or permitted clients in Canada only. Any review, re-transmission, dissemination or other use of this information by persons or entities other than the intended recipient is prohibited.