Managing alternatives with alternative data

Navigating the U.S. government shutdown

The U.S. government once again entered a shutdown on October 1st, 2025, as Democrats and Republicans hardened their positions around President Trump’s controversial budget bill.

In addition to the 750,000 federal workers that could be furloughed, a U.S. government shutdown also disrupts the flow of various economic data reports released by agencies such as the Bureau of Labor Statistics (BLS), the Bureau of Economic Analysis (BEA), and the Census Bureau.

The lack of economic data leaves investors potentially flying blind. Luckily, at PICTON Investments we already leverage a wide variety of data sets to help inform our investment decisions. While many of them are publicly available datasets from government sources, we also regularly look at alternative data sets to provide greater context.

Some of the key economic data reports affected by a government shutdown include:

Employment Data: This includes the monthly jobs report, weekly jobless claims, and other labour market indicators.

Inflation Reports: The Consumer Price Index (CPI), Producer Price Index (PPI), and data on import prices and personal consumption expenditures (PCE) price index

Economic Activity: Reports on Gross Domestic Product (GDP), PCE and Retail Sales

Housing and Construction: Data related to housing and construction spending

During a government shutdown, economists and investors tend to turn to a variety of alternative data sources to fill the gap left by the lack of official government statistics. While these alternatives can provide some level of insight, they often come with limitations including smaller sample sizes and different methodologies than the official reports. Examples of alternative data sources for different economic categories include:

Employment and jobless claims

ADP National Employment Report: This monthly report tracks payrolls for private-sector employers and is often seen as a key alternative to the official jobs report.

Indeed and other job websites: Companies like Indeed and LinkUp track online job postings, which offer insight into labour demand.

Homebase: This payroll and scheduling company tracks data from over 150,000 small businesses.

Chicago Fed data: The Federal Reserve Bank of Chicago publishes its own labour market data series.

Inflation reports

Institute for Supply Management Purchasing Managers’ Index (ISM PMI), Regional Federal Reserve Survey, National Federation of Independent Business (NFIB)Survey: The full reports from these groups include "Price" sub-components that can indicate inflationary pressures for both the manufacturing and services sectors.

University of Michigan and Other Consumer Survey Data: These surveys highlight changes in consumer inflation expectations and perceptions of inflation levels

Real estate rental data: Companies like Zillow track real estate rental rates to help paint a picture of inflation.

Economic Activity

Federal Reserve surveys: The Federal Reserve continues to produce its own economic surveys, including regional manufacturing reports, as well as the Senior Loan Officer Opinion Survey.

Institute for Supply Management and Services Purchasing Managers’ Index (ISM PMI): These reports provide a measure of overall economic activity.

Credit card spending data: Reports on credit card spending from banks like Bank of America and JP Morgan Chase can be used to estimate consumer demand.

Redbook weekly same-store sales: This index measures sales performance at comparable U.S. retail stores.

Business surveys: The Conference Board's Consumer Confidence Survey and the NFIB's small business report offer additional insight.

Housing and construction

CoreLogic and Zillow: These real estate technology companies track the vast majority of home transactions and rental rates in the U.S.

Mortgage Bankers Association (MBA): The MBA provides weekly data on mortgage applications.

National Association of Home Builders (NAHB): The NAHB releases a monthly housing index.

Below is a table that summarizes these alternative data sources:

Economic Data in a Government Shutdown

Category | Official Reports to Affected | Alternative Sources |

|---|---|---|

Employment | Payrolls, Jobless Claims, Labor Market indicators | ADP Jobs, Indeed Postings, Homebase, Chicago Fed Labor Data |

Inflation | CPI, PPI, Import Prices, PCE Price Index | ISM Prices, Philly Fed Prices, NFIB Expected Prices, UofM Survey, Zillow Rent Index |

Economic Activity | GDP, PCE, Retail Sales | Fed Regional Surveys, ISM PMI (Man. & Services), SLOOS, Credit Card Data, Redbook Sales, Conf. Boards Confidence, NFIB Small Biz |

Housing & Construction | Housing Starts, Building Permits, Construction Spending | CoreLogic, Zillow, MBA Mortgage Apps, NAHB Housing Index |

What Does This Mean for Investors Today?

The Federal Reserve (Fed) uses official reports to make decisions regarding interest rates raises or cuts. Delays in data release may affect their ability to make informed decisions. For example, the Fed recently cut rates on September 17 by 25 basis points down to the range of 4.00-4.25%, on the back of a shift in focus to labour market weakness. Since then, markets have become more tuned into recession fears once again. In terms of employment indicators, the official payrolls data prior to the US government shutdown was looking weak, so this upcoming report was particularly important. Now, because of the federal shutdown we don't have that information, therefore we are forced to look for other data sources regarding the health of the labour market.

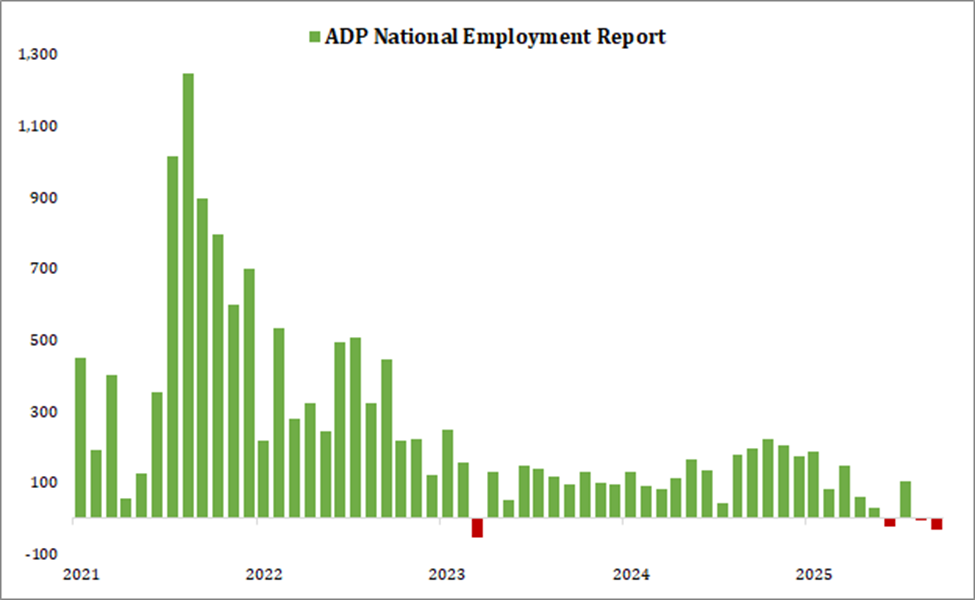

The ADP employment data that came out last week indeed showed negative growth; this representative data point now takes on inordinately larger importance for investors given the lack of official payrolls data:

The delay in the collection and release of official key economic data represents a considerably tricky and uncertain environment for policy markers, businesses, money managers and investors alike. Critical data, such as labour market indicators, has already been impacted, potentially leaving individuals and institutions no option but to obtain a pulse on the economy from alternative, unofficial sources.

As expected, the longer the U.S. government shutdown lasts, the larger the number of surveys and census data that could be negatively impacted, thus possibly further harming the quality of valuable statistics employed by business, investors, economists and government agencies.

At PICTON Investments, our experienced team of investment professionals continuously monitors and analyzes the available economic data to help ensure that our unique and disciplined investment process continues to deliver on our goal to help investors reach their long-term financial goals with greater certainty.

Definitions:

Philly Fed Prices: Federal Reserve Bank of Philadelphia Business Outlook Survey

UofM Survey: University of Michigan Consumer Sentiment Survey

GDP: Gross Domestic Product

Fed Regional Surveys refers to regional Federal Reserve Banks of various U.S. states

SLOOS: Senior Loan Offices Opinion Survey on Bank Lending

NFIB Small Biz: National Federation of Independent Business Survey of Small Businesses

This material has been published by PICTON Investments on October 14, 2025

It is provided as a general source of information, is subject to change without notification and should not be construed as investment advice. This material should not be relied upon for any investment decision and is not a recommendation, solicitation or offering of any security in any jurisdiction. The information contained in this material has been obtained from sources believed reliable, however, the accuracy and/or completeness of the information is not guaranteed by PICTON Investment, nor does PICTON Investment assume any responsibility or liability whatsoever. All investments involve risk and may lose value. This information is not intended to provide financial, investment, tax, legal or accounting advice specific to any person, and should not be relied upon in that regard. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional.

This material may contain “forward-looking information” that is not purely historical in nature. These forward-looking statements are based upon the reasonable beliefs of PICTON Investment as of the date they are made. PICTON Investment assumes no duty, and does not undertake, to update any forward-looking statement. Forward-looking statements are not guarantees of future performance, are subject to numerous assumptions and involve inherent risks and uncertainties about general economic factors which change over time. There is no guarantee that any forward-looking statements will come to pass. We caution you not to place undue reliance on these statements, as a number of important factors could cause actual events or results to differ materially from those expressed or implied in any forward-looking statement made.

Commissions, trailing commissions, management fees, performance fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Alternative mutual funds can only be purchased through a registered dealer and are available only in those jurisdictions where they may be lawfully offered for sale.

There is no guarantee that a hedging strategy will be effective or achieve its intended effect. The use of derivatives or short selling carries several risks which may restrict a strategy in realizing its profits, limiting its losses, or, which cause a strategy to realize or magnify losses. There may additional costs and expenses associated with the use of derivatives and short selling in a hedging strategy.

This material is confidential and is intended for use by accredited investors or permitted clients in Canada only. Any review, re-transmission, dissemination or other use of this information by persons or entities other than the intended recipient is prohibited.