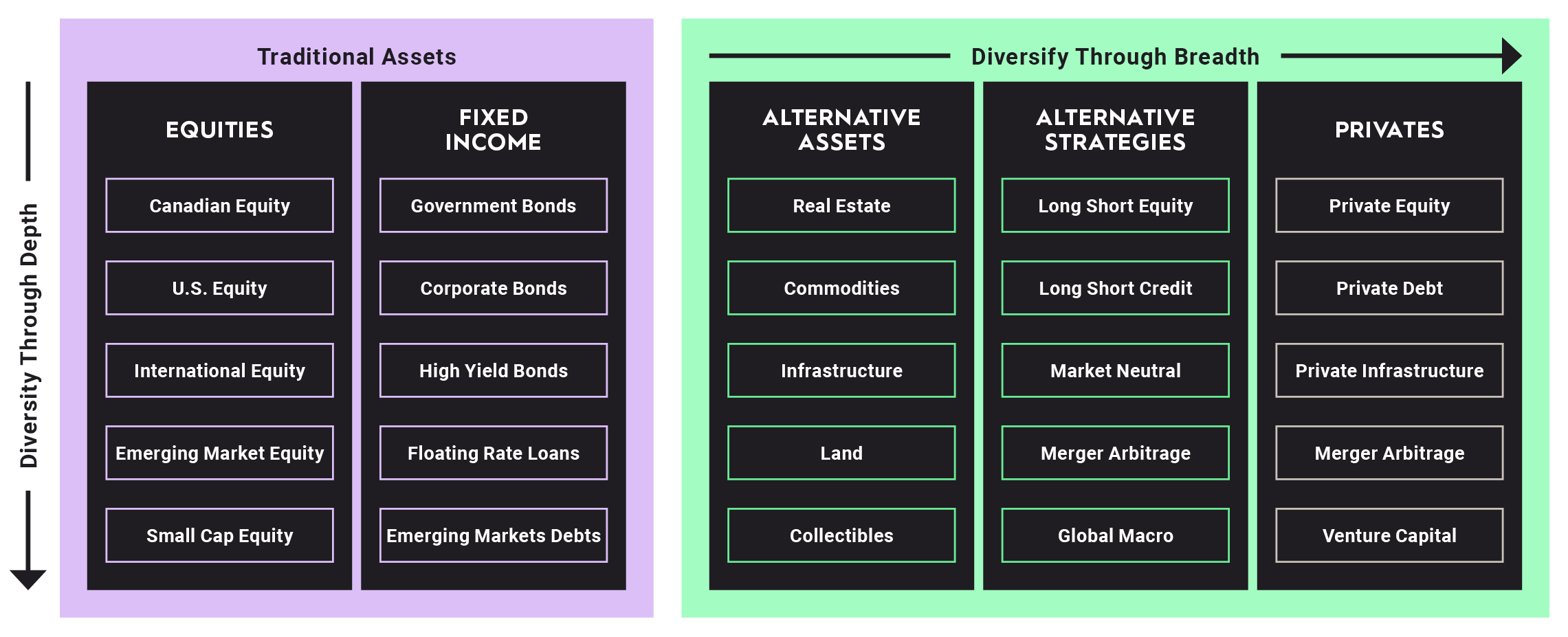

WHAT ARE ALTERNATIVES?

WE BELIEVE A RESILIENT PORTFOLIO NEEDS STOCK, BONDS, AND ALTERNATIVES

ALTERNATIVES OFFER MORE THAN JUST DIVERSIFICATION, THEY CAN OFFER GREATER VALUE

Our alternatives could provide a powerful third pillar in your investment portfolio. We search globally for best-in-class managers & investments professionals who are incentivized to deliver strong performance, giving you greater value for cost.

Our alternatives can offer two key benefits. First, they may offer asymmetric returns meaning they are designed to capture upside in strong markets and help cushion the downside when markets fall. Second, they could provide uncorrelated return streams meaning that they are not correlated to market moves providing you with less market volatility. By complementing traditional stocks and bonds, alternatives can help build a more resilient investment portfolio and aim to support more stable, consistent long-term returns.

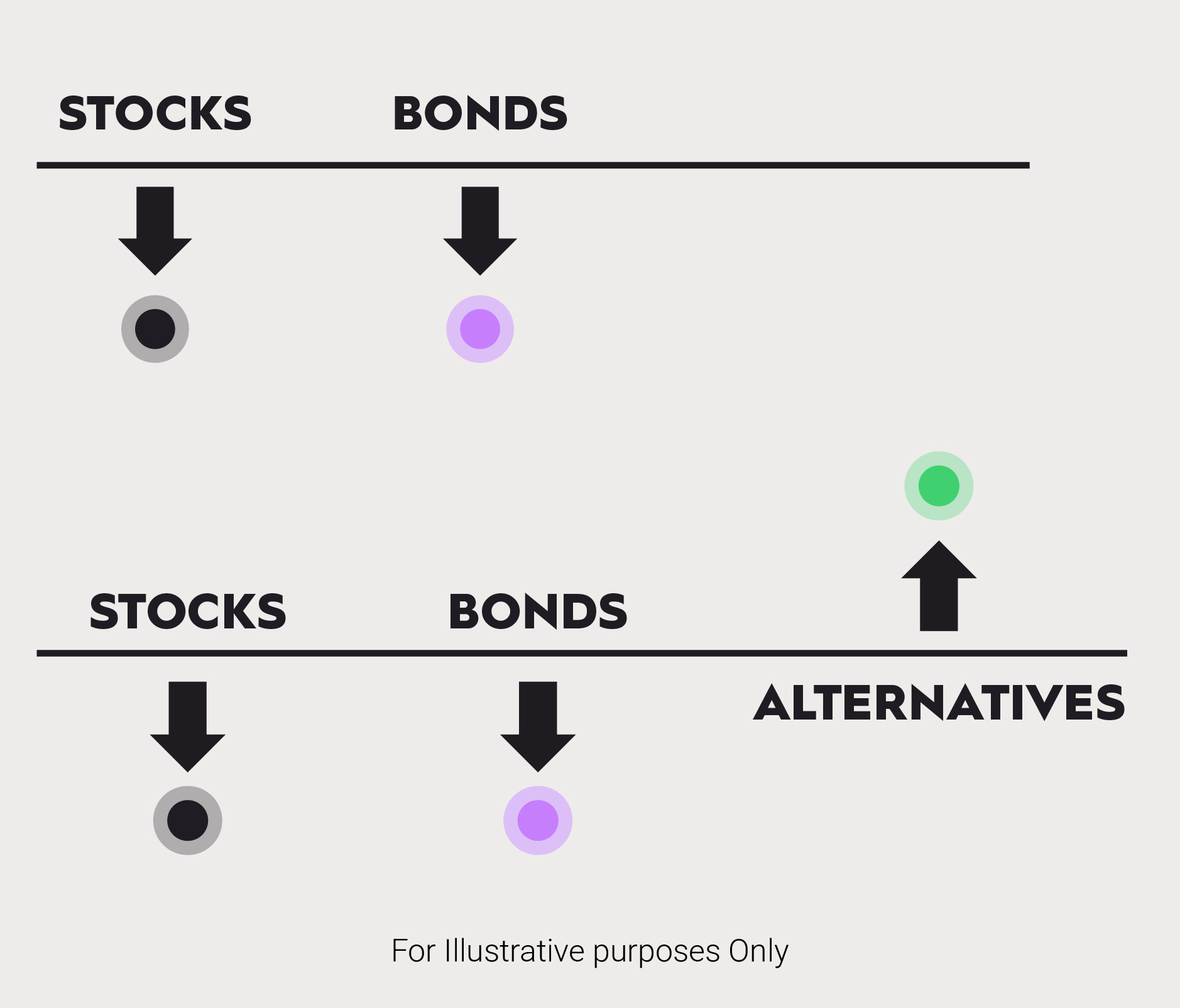

ALTERNATIVES DIVERSIFY DIFFERENTLY

DESIGNED TO PERFORM BETTER ACROSS MARKET CONDITIONS

Historically, stocks and bonds generally moved in the opposite direction. In today’s market, they could move in the same direction more frequently. That’s why you need Alternatives. When stocks and bonds move together, Alternatives could stand apart and provide more diversification.

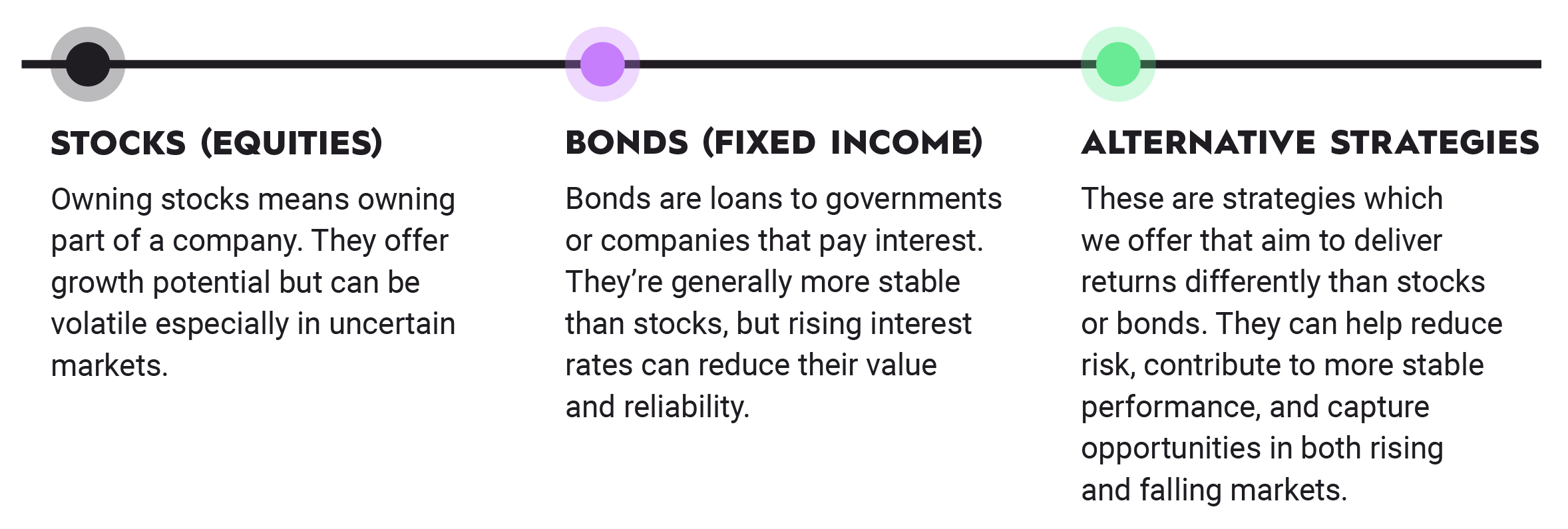

ALTERNATIVES CAN PROVIDE GREATER DIVERSIFICATION: DEPTH + BREADTH

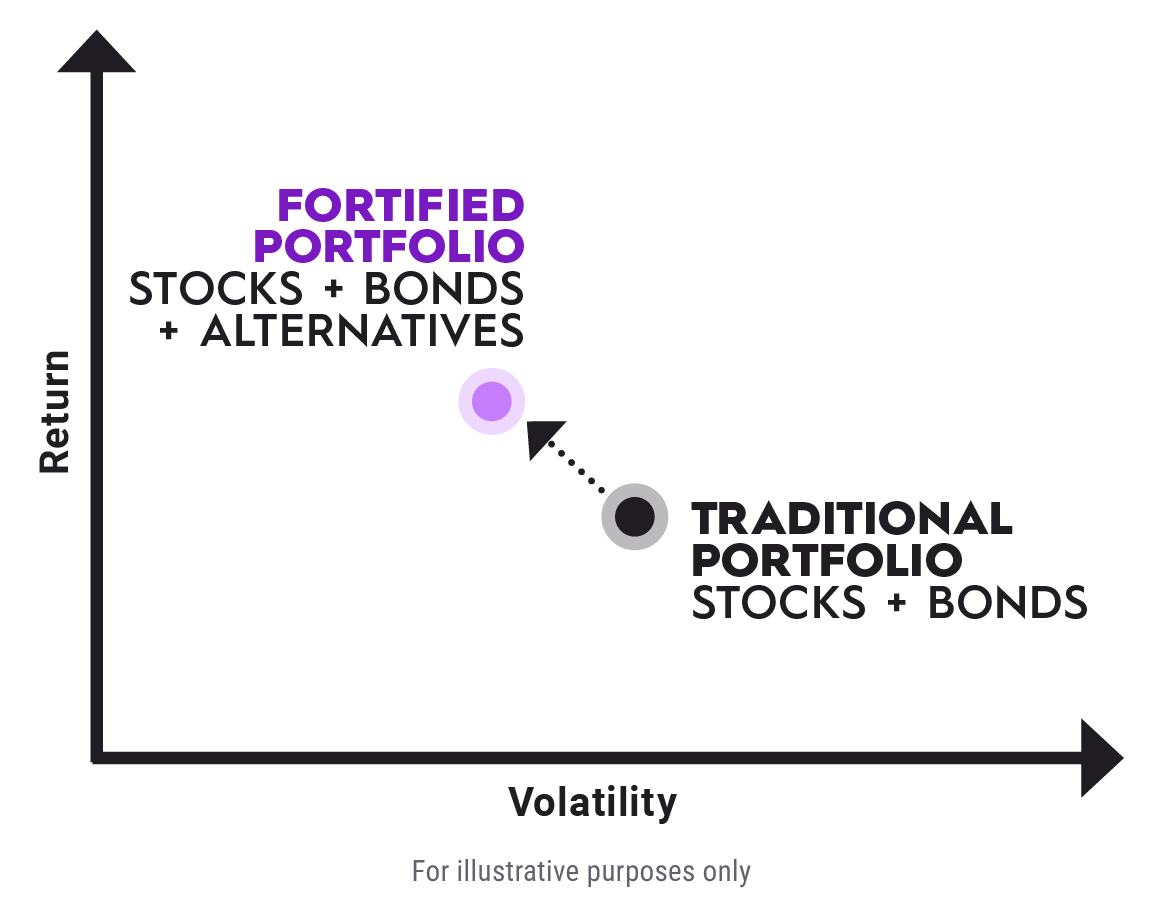

THE BOTTOM LINE:

PORTFOLIOS BUILT WITH ALTERNATIVES CAN BE MORE DIVERSIFIED WHILE AIMING TO DELIVER OPTIMAL RISK-RETURN OUTCOMES

In today’s environment, a portfolio with just stocks and bonds isn’t enough. Adding alternatives can create a stronger foundation. More balance. More strength. Greater certainty

Disclosure

This material has been published by PICTON Investments on August 20, 2025. It is provided as a general source of information, is subject to change without notification and should not be construed as investment advice. This material should not be relied upon for any investment decision and is not a recommendation, solicitation or offering of any security in any jurisdiction. The information contained in this material has been obtained from sources believed reliable, however, the accuracy and/or completeness of the information is not guaranteed by PICTON Investments, nor does PICTON Investments assume any responsibility or liability whatsoever. All investments involve risk and may lose value. This information is not intended to provide financial, investment, tax, legal or accounting advice specific to any person, and should not be relied upon in that regard. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional.

Any review, re-transmission, dissemination or other use of this information by persons or entities other than the intended recipient is prohibited.