The Value of a Total Portfolio Approach

Building resilient portfolios for a new era

For decades, many investment practitioners have been relying upon a Strategic Asset Allocation (SAA) framework as the foundation to their portfolio construction approach.

But today, leading global investors and research bodies are calling for a new allocation method: the Total Portfolio Approach (TPA). TPA aims to put client goals front and centre, assessing investment decisions based on how they will contribute to the certainty with which goals are achieved.

For investment advisors, this shift of focus can provide a compelling framework to enhance the integration between financial planning and investment workflows. By bringing these two disciplines together, advisors that embrace TPA may be better positioned to align their client goals with the financial plan and investment portfolio and potentially delivering improved outcomes.

Why Portfolio Construction Needs a Rethink

The SAA portfolio construction framework is built on the assumption that the law of large numbers will prevail and that over the long run, outcomes will converge towards expected returns.

This assumption may not hold true for individual investors whose actual outcomes can diverge meaningfully from the average due to time horizon and cash flow needs. In particular, SAA generally does not adequately address the risk of early retirement losses, which can result in outsized impact on retirement spending power and may increase the risk of portfolio depletion.

Additional structural challenges that necessitate a shift away from the SAA framework include:

Lack of a shared risk language – SAA typically treats each asset class as a separate entity, analyzed in isolation. This fragmented approach can make it challenging to measure and monitor the true risk exposures of the entire portfolio.

Lack of responsiveness to market conditions – SAA often anchors investors to a rigid portfolio mix. If something isn’t attractive, it shouldn’t be included just because there is a need to fill a pre-set bucket. Capital should be allocated to the highest value opportunities.

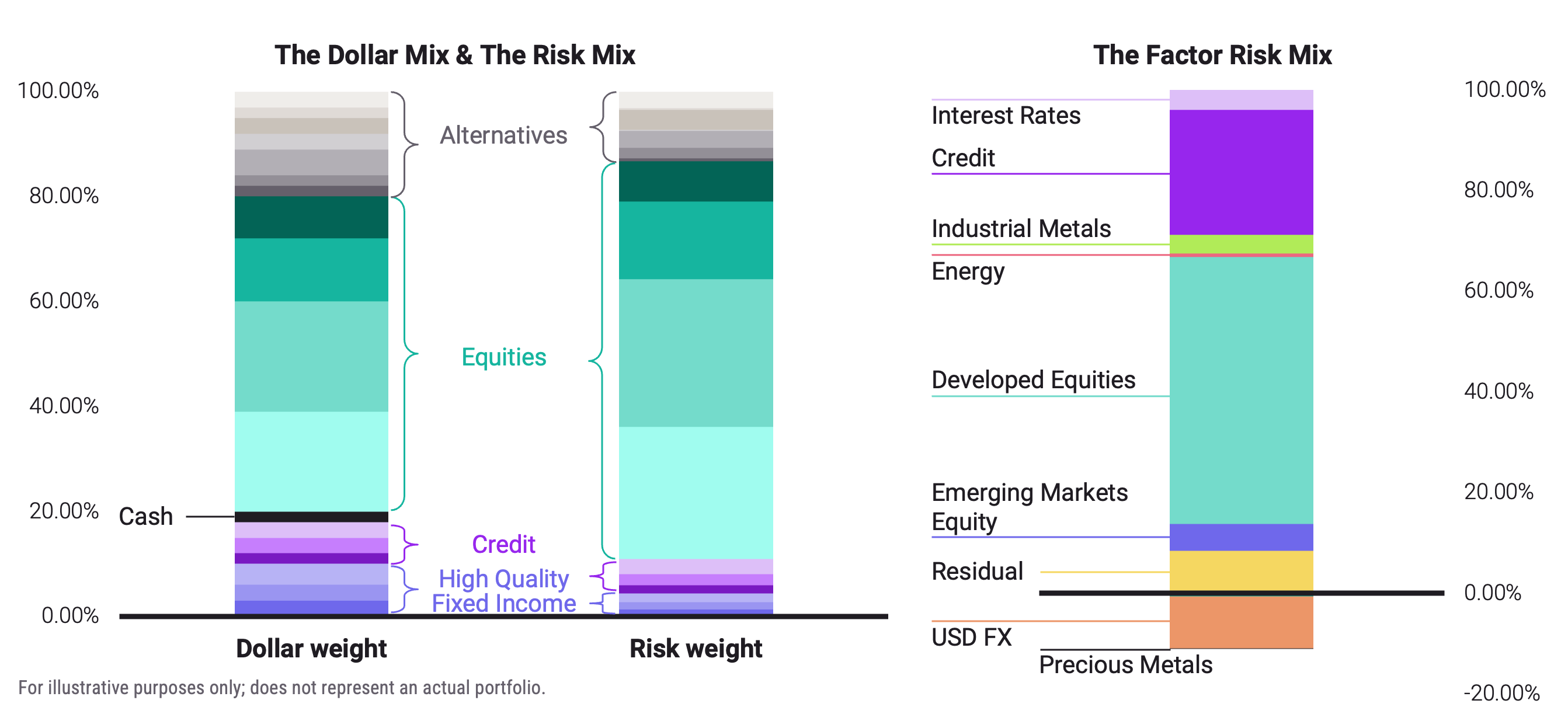

Label based diversification – SAA typically diversifies portfolios by spreading investments across asset classes such as equity, fixed income and alternatives. However, this may fail to address the underlying exposures that drive the performance and risk of each asset. For example, fixed income allocations may carry exposure to equity risk, equity allocations to fixed income risk and alternative allocations to both equity and fixed income risks. As investment advisors construct true multi-asset, multi-strategy portfolios, this approach to diversification may no longer be considered effective. The visual below demonstrates how a portfolio that looks diversified on paper can actually has a high concentration of risk:

The Total Portfolio Approach: Moving from allocation by label to alignment by goal

TPA can help advisors move past “label-based diversification” by analyzing portfolios based on the underlying risk factors that actually drive performance. Instead of asking what asset classes do I hold, the TPA mindset asks what risks am I truly exposed to and how do they shape my portfolio?

At its core, TPA could be a "next best dollar" framework built around four key tenets:

1. Goal Alignment

Each investment decision is aligned with a specific client objective, rather than being driven by an asset allocation target. The central question is, "How will this impact the portfolio’s ability to achieve it’s goals?"

2. Competition for Capital

In TPA, no capital allocation decision is simply given. Opportunities should compete for capital based on their marginal contribution to the total portfolio’s ability to achieve investor goals.

3. Unified Risk Lens

TPA mandates a single risk framework that aims to measure and manage risk across all holdings within a portfolio. By quantifying exposure to core risk factors (e.g., inflation sensitivity, interest rate risk, credit spreads), advisors can design purpose-built portfolios that can achieve true diversification.

4. Dynamic Flexibility

TPA is not a static map; it is like a GPS. Portfolios are adjusted dynamically for changing economic conditions and market opportunities, with the goal to optimizing the route to the client's goal.

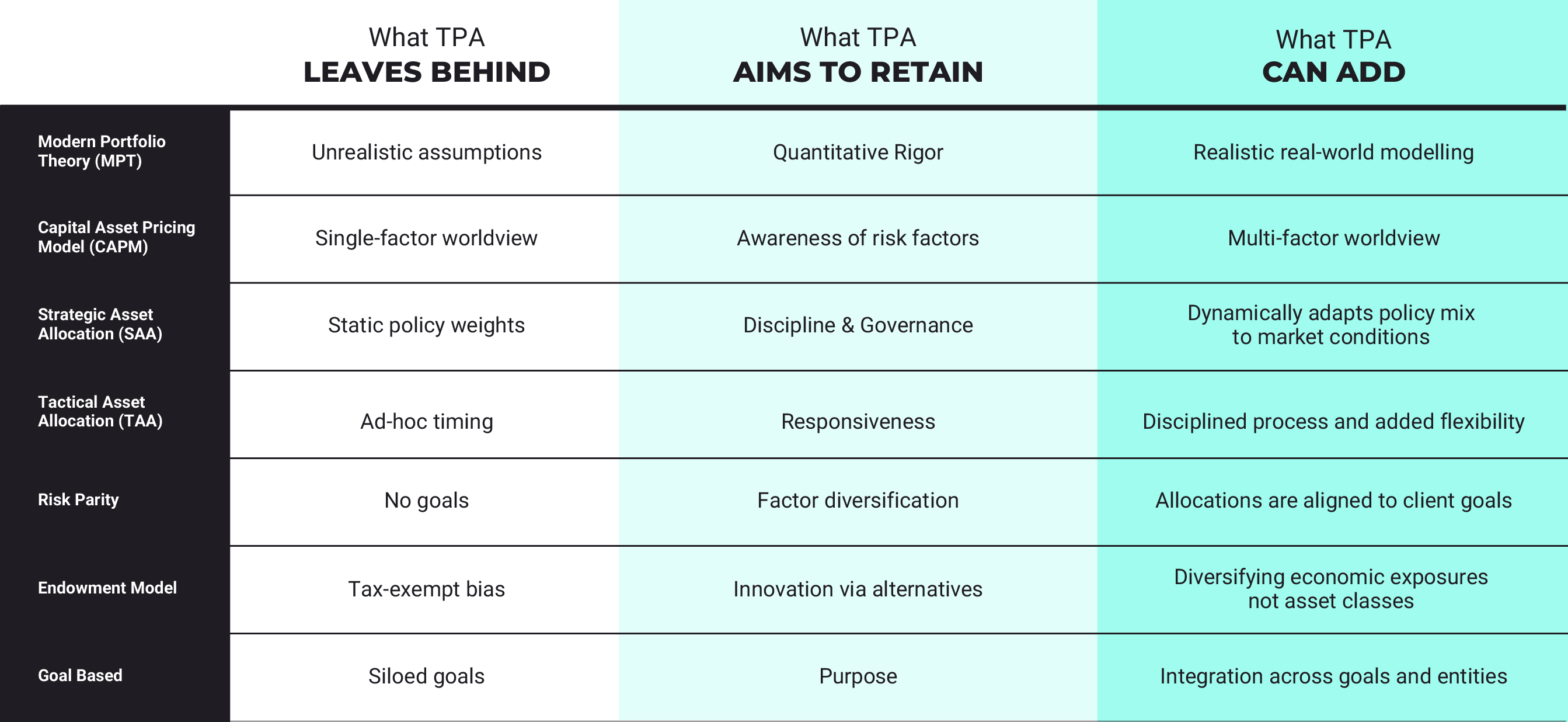

TPA is not a revolution that requires abandoning decades of experience, but an evolution that relies on decades of innovation in portfolio construction. This table below illustrates how the research, principles and insights gained over decades are integrated to create a unified, adaptive framework that builds on the key elements of existing models.

Potential Benefits for Advisors Who Adopt the TPA

For years, leading pension funds and endowments have been utilizing TPA principles to manage complexity around their client assets. This discipline can now be accessible to advisors, supported by advanced data and technology. Advisors who adopt this framework signal to their clients that their capital is managed with the similar rigor and intentionality as the world’s most sophisticated asset managers.

Advisors who implement the Total Portfolio Approach can also potentially enhance their value proposition by fostering greater alignment between their client’s goals, financial plans, and investment portfolios.

This may translate into tangible business wins for advisors working with both high net worth and mass affluent clients:

For high-net-worth clients with concentrated wealth (like private business equity or substantial real estate): TPA can provide advisors with a compelling framework to redesign the client portfolios to be more liquid. By making adjustments to strategically offset certain concentrated risk exposures outside of the investable portfolio, advisors can help support diversification in their client’s overall net worth with the aim to achieve their goals across a broader range of economic or market scenarios.

For Mass Affluent clients: TPA can help advisors more closely align their client’s financial plan with their portfolio so that their clients can retire with confidence and can maintain their desired lifestyle throughout retirement.

Implementing TPA: Stocks and Bonds Are Generally Not Enough

Portfolios constructed solely from stocks and bonds may lack the breadth of diversification needed to enhance the likelihood of their client achieving their financial goals. This is because while these building blocks generally provide good diversification against growth shocks, with equity risk typically benefits from upside growth surprises and interest rate risk from downside growth surprises, they tend to amplify exposure to inflation shocks.

Relying on a narrow set of risk factors that drive the performance of these assets may result in an unnecessarily concentrated portfolio that may lack the resilience needed to be robust across different market environments.

Under a TPA framework, alternatives are not merely add-ons; they can be core components that can reshape the portfolio’s risk profile. They offer the opportunity to incorporate diversifying assets and strategies with the potential to broaden the array of risk factors in a portfolio. In this way, true diversification can be achieved.

For advisors, the shift toward TPA is a journey, not a leap. You can begin advancing along the TPA spectrum today by considering these foundational steps:

Start Taking a Total Portfolio View: Utilize a broad reference portfolio to measure overall value add, leveraging specialized tools designed for use with multi-asset, multi-strategy portfolios.

Encourage Competition for Capital: Reorganize your manager monitoring lists by removing restrictive labels and allowing diverse investments (for example, equity funds, private equity funds and long short equity hedge funds) to compete based on the role they can play in helping the overall portfolio to achieve its goals.

Build a “Shadow Portfolio”: Create a shadow portfolio to simulate a partial TPA implementation; observe and compare its performance and behaviour against your current asset allocation.

Identify Implementation Priorities: Sequence your changes intelligently by addressing high-impact areas like missing diversifiers first before focusing on fine-tuning how existing risk exposures like equity or fixed income can be accessed.

Think Ahead: Develop a playbook for how you can dynamically adjust the portfolio’s allocation in response to various future economic scenarios.

Advisors who start adopting the principles of TPA today can enhance their practice by showing their clients how they can add value through more intentional portfolio construction. This can mean using a goal-based mindset to build portfolios that are designed to be responsive to changing market dynamics and their clients’ financial goals.

This material has been published by PICTON Investments on November 17, 2025. It is provided as a general source of information, is subject to change without notification and should not be construed as investment advice. This material should not be relied upon for any investment decision and is not a recommendation, solicitation or offering of any security in any jurisdiction. The information contained in this material has been obtained from sources believed reliable, however, the accuracy and/or completeness of the information is not guaranteed by PICTON Investments, nor does PICTON Investments assume any responsibility or liability whatsoever. All investments involve risk and may lose value. This information is not intended to provide financial, investment, tax, legal or accounting advice specific to any person, and should not be relied upon in that regard. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional.

This material is intended for use by accredited investors or permitted clients in Canada only. Any review, re-transmission, dissemination or other use of this information by persons or entities other than the intended recipient is prohibited.