UNDERSTANDING INVESTMENT FEES

Fees are often misunderstood as something to minimize. At PICTON Investments, you only pay more when your investments perform.

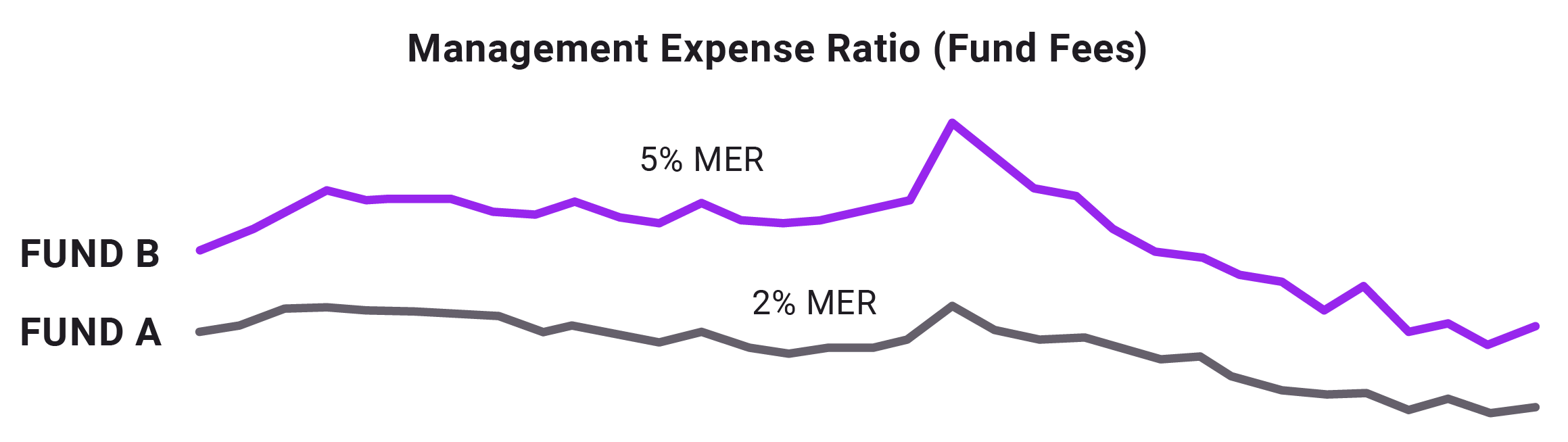

Let’s say you’re comparing two funds:

• Fund A reports a 2% Management Expense Ratio (MER)

• Fund B reports a 5% Management Expense Ratio (MER)

At first glance, you might pick Fund A because of its lower cost

*A Management Expense Ratio (MER) is the annual fee a fund charges to cover its operating costs, expressed as a percentage of your investment.

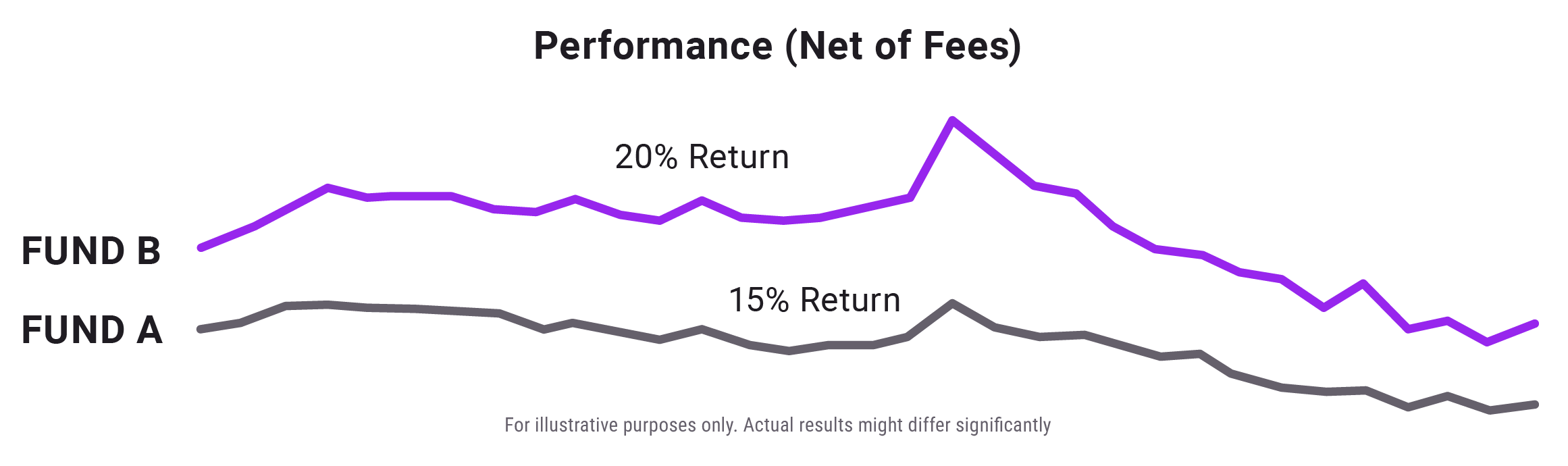

Now look at each fund’s performance. Fund B’s performance is better.

Fund B has a higher MER because of strong performance that triggered performance fees, meaning the fund generates excess return for investors. When the net-of-fee performance is superior, the fund is providing greater value for the cost.

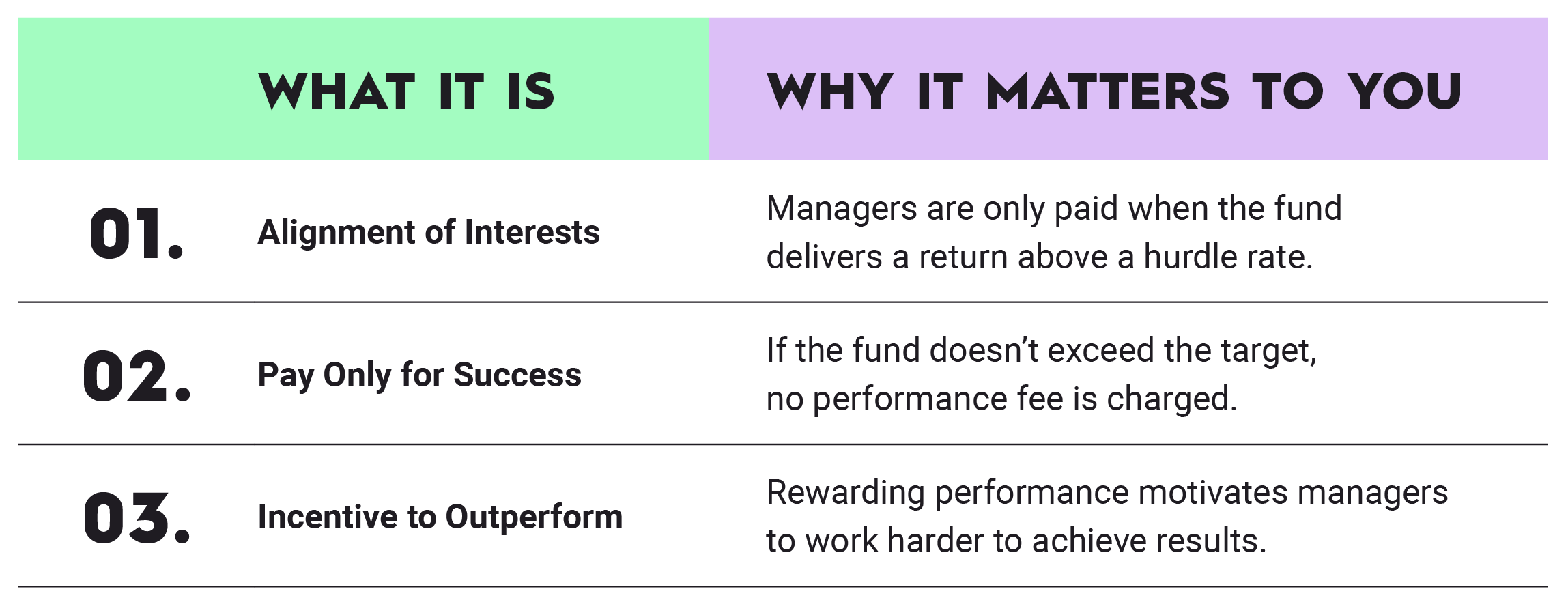

WHY PERFORMANCE FEES CAN HELP ALIGN INTERESTS

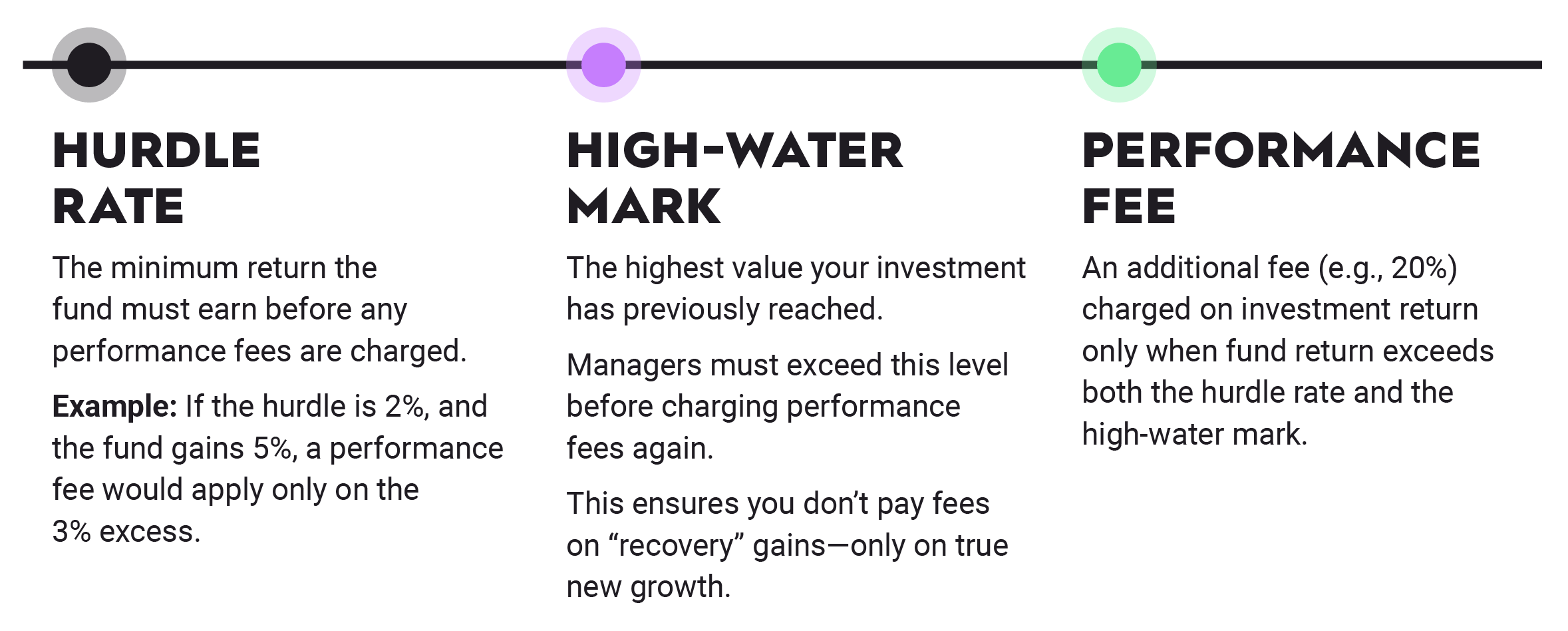

Performance fees are earned only when a fund exceeds a specific return threshold, such as a hurdle rate or benchmark. Unlike management fees, which are charged regardless of return, performance fees reward managers for strong performance and ensure investors only pay when they benefit. This helps align the interests of fund managers and investors.

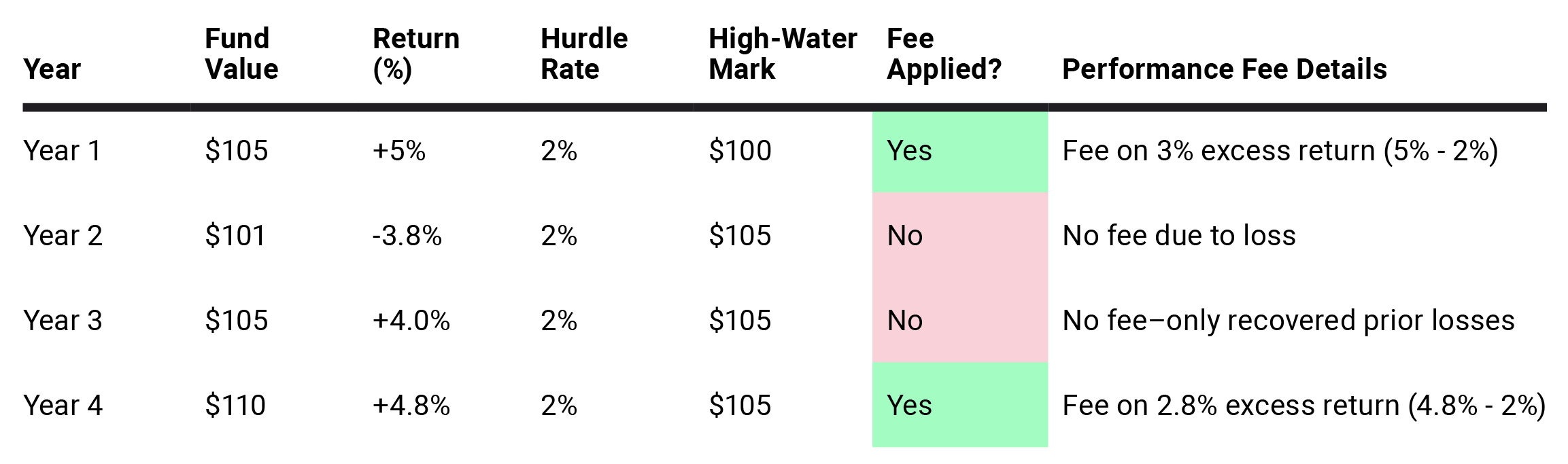

REAL EXAMPLE: HOW IT WORKS

Let’s say you invest $100 into a fund:

THE BOTTOM LINE:

At PICTON Investments, we believe fees should work for you, not against you. Performance fees are designed to reward results, not effort. You’re not paying for activity, you’re paying for results and outcomes. So don’t just ask, “What am I paying?” Ask, “What value am I getting in return?”

With the right strategy and the right incentives, the answer is often: more than you expected.

Disclosure

This material has been published by PICTON Investments on August 20, 2025. It is provided as a general source of information, is subject to change without notification and should not be construed as investment advice. This material should not be relied upon for any investment decision and is not a recommendation, solicitation or offering of any security in any jurisdiction. The information contained in this material has been obtained from sources believed reliable, however, the accuracy and/or completeness of the information is not guaranteed by PICTON Investments, nor does PICTON Investments assume any responsibility or liability whatsoever. All investments involve risk and may lose value. This information is not intended to provide financial, investment, tax, legal or accounting advice specific to any person, and should not be relied upon in that regard. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional.

Any review, re-transmission, dissemination or other use of this information by persons or entities other than the intended recipient is prohibited.