THE NEW FORTIFIED PORTFOLIO

HIGH CORRELATIONS | GREATER UNCERTAINTY | THE NEED FOR MORE ROBUST SOLUTIONS

THE TRADITIONAL 60/40 PORTFOLIO

For decades, the traditional portfolio of 60% equities and 40% bonds was an effective, dependable model for diversifying risk and returns. But with the increasing correlation between the performance of stocks and bonds, the 60/40 portfolio is under tremendous pressure. Enter the new math for today’s world.

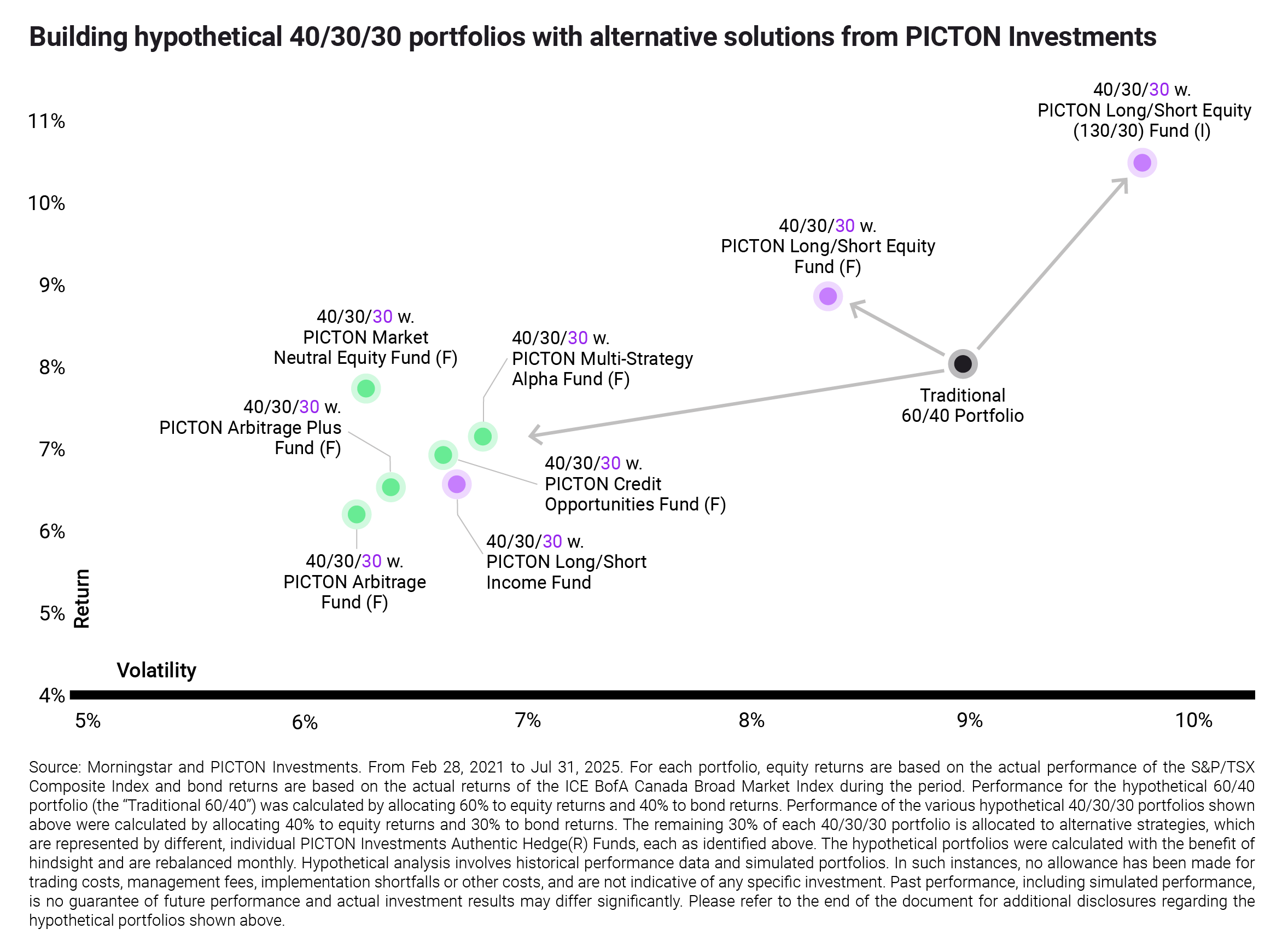

WHY 40/30/30 IS A MORE ROBUST SOLUTION

We believe that continued market volatility will be driven by inflation shocks, which will negatively impact both stocks and bonds. Amid volatile markets, investors have a greater need to fortify their portfolios with Alternative Strategies that are generally less dependent on interest rates and equity markets.

THE NEW 40/30/30 PORTFOLIO

There are two main types of alternative investments:

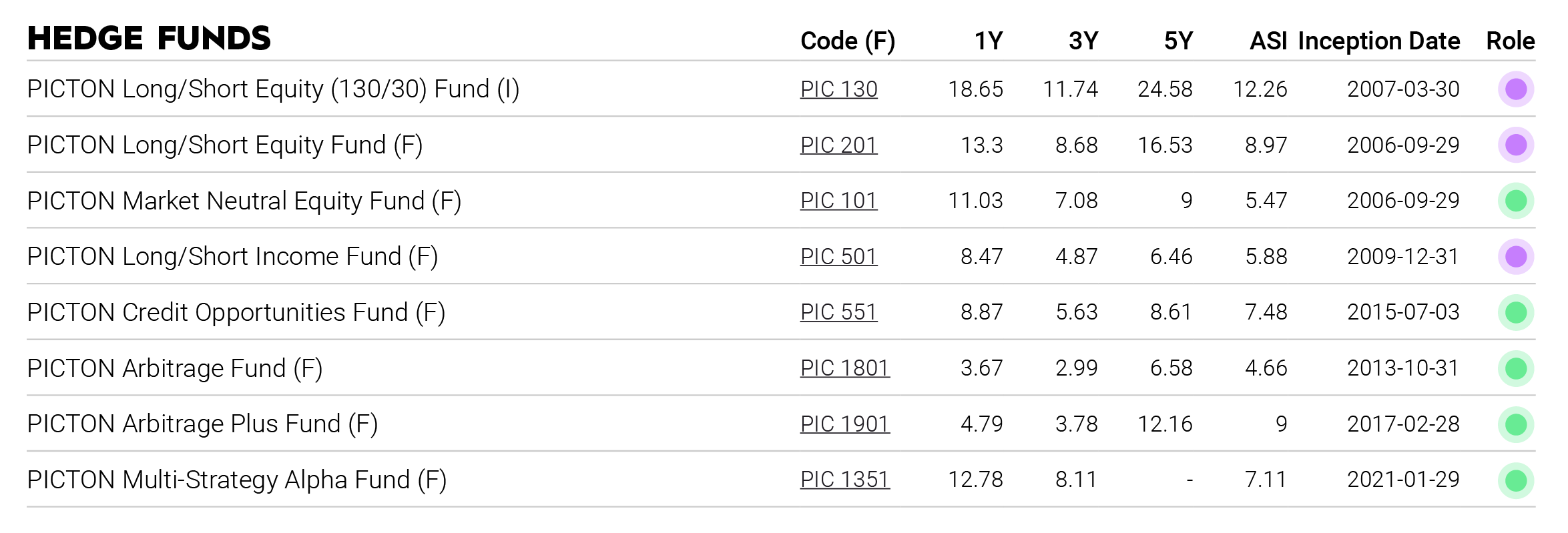

FORTIFY & HOLD WITH ALTERNATIVE STRATEGIES

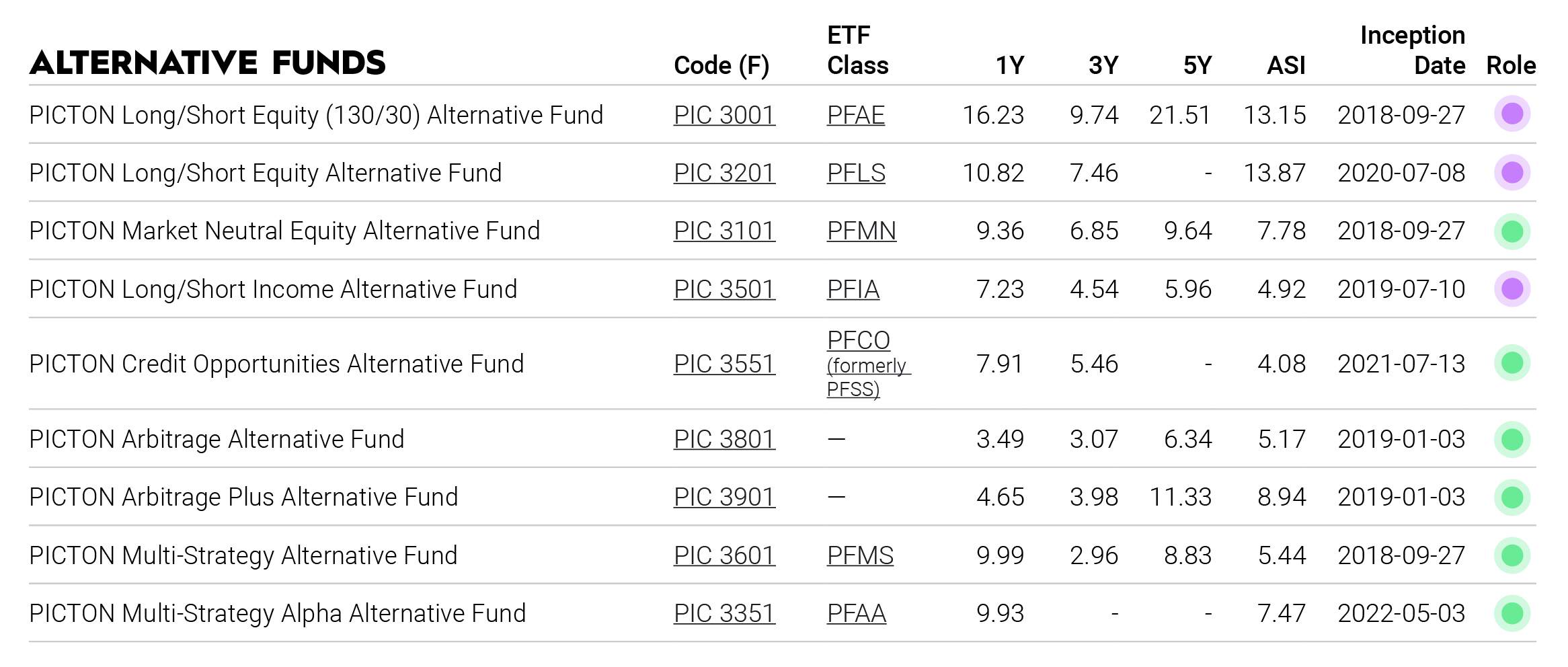

In addition to Hedge Funds, we also offer similar strategies as Alternative Funds.

Disclosure

This material has been published by PICTON Investments on July 17, 2025. It is provided as a general source of information, is subject to change without notification and should not be construed as investment advice. This material should not be relied upon for any investment decision and is not a recommendation, solicitation or offering of any security in any jurisdiction. The information contained in this material has been obtained from sources believed reliable, however, the accuracy and/or completeness of the information is not guaranteed by PICTON Investments, nor does PICTON Investments assume any responsibility or liability whatsoever. All investments involve risk and may lose value. This information is not intended to provide financial, investment, tax, legal or accounting advice specific to any person, and should not be relied upon in that regard. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional.

© 2025 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Any information and data pertaining to an index relate only to the index itself and not to any investment product based on the index. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading, but are based on the historical returns of the selected investments, indices or investment classes and various assumptions of past and future events. Also, since the trades have not actually executed, the results may have under or overcompensated for the impact of certain market factors. In addition, hypothetical trading does not involve financial risk. No hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of the trading losses are material factors which can adversely affect the actual trading results. There are numerous other factors related to the economy or markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results, all of which can adversely affect trading results. The simulated performance results also assume that asset allocations, securities or investments would not have changed over time and in response to market conditions, which might have occurred if an actual account had been managed during the time period shown.

Commissions, trailing commissions, management fees, performance fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Alternative mutual funds can only be purchased through a registered dealer and are available only in those jurisdictions where they may be lawfully offered for sale. The offering of units of the Picton Mahoney Authentic Hedge® funds are made pursuant to an Offering Memorandum only to those investors in jurisdictions of Canada who meet certain eligibility or minimum purchase requirements. Prospective investors should consult with their investment advisor to determine suitability of investment. Please see the fund’s Confidential Offering Memorandum for more information, including investment objectives and strategies, risk factors and investor eligibility. Past performance is no guarantee of future performance. Class F performance for the fund(s) shown is net of management fees, performance fees, transaction costs and expenses. Class I performance for the fund(s) shown is gross of management fees and performance fees, and net of transaction costs and expenses.

Picton Mahoney Asset Management is a registered trademark of Picton Mahoney Asset Management. All other trademarks are the property of their respective owners.

Effective June 13, 2025, (I) Picton Mahoney Fortified Active Extension Alternative Fund has changed its name to PICTON Long/Short Equity (130/30) Fund; Picton Mahoney Fortified Long Short Alternative Fund has changed its name to PICTON Long/Short Equity Fund (F); Picton Mahoney Fortified Market Neutral Alternative Fund has changed its name to PICTON Market Neutral Equity Fund (F); Picton Mahoney Fortified Income Alternative Fund has changed its name to PICTON Long/ Short Income Fund (F); Picton Mahoney Fortified Special Situations Alternative Fund has changed its name to PICTON Credit Opportunities Fund (F); Picton Mahoney Fortified Arbitrage Alternative Fund has changed its name to PICTON Arbitrage Fund (F); and, Picton Mahoney Fortified Arbitrage Plus Alternative Fund has changed its name to PICTON Arbitrage Plus Fund (F)