Smarter Fee Budgeting

Shifting Capital Allocations to optimize portfolios

A competitive advantage for modern advisors

In many ways, portfolio construction is the art and science of allocating scarce resources to maximize the likelihood of achieving financial goals. There are four main budgeting categories that should be allocated thoughtfully and deliberately: risk, alpha, fees, and tax. Each of these is finite: overspending in one area can limit effectiveness elsewhere, and neglecting any one of them can undermine an investor’s entire strategy.

Rising global trends towards fee transparency including Total Cost Reporting Enhancements (“TCR” and also known as “CRM3”) in Canada could create a value defining moment for investment professionals. Advisors who apply modern best practices for allocating their portfolio’s fee budget could elevate the value of their advice, potentially delivering better client outcomes, differentiating their practice and attracting new business. In this article, we will explore what these modern best practices look like and how a fee budget can be allocated more efficiently to help advisors achieve their client goals with greater certainty.

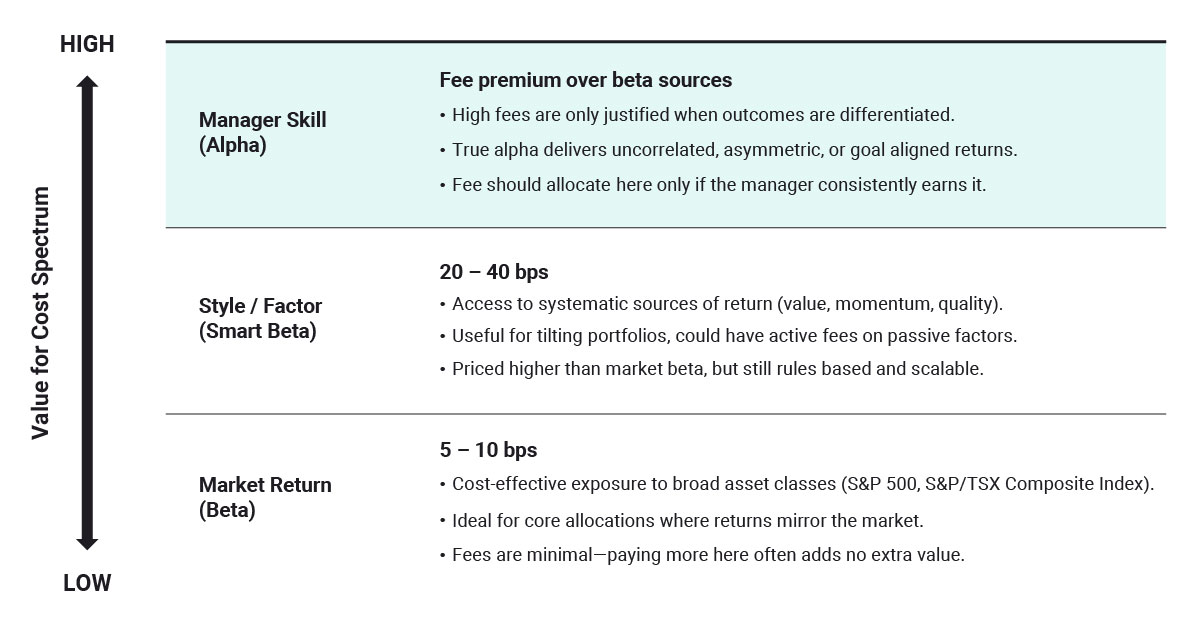

Understanding the value of an investment strategy

Investment strategy returns can be broken down into three parts: market, style and skill. By dissecting the sources, we can aim to determine the true value of that investment strategy. Broad market exposure or beta is cheap and plentiful. It can generally be accessed cost efficiently. Style or factor exposures are scalable and can be accessed via systematic rules-based approaches, however they require thoughtful implementation. Manager skill is rare, valuable and capacity constrained and should command a meaningful fee premium over market and style returns.

For illustrative purposes only

Put more simply, a portfolio’s fee budget is best spent on paying for manager skill. In terms of outcome, this means focusing fee budget on allocations that can offer the potential to deliver asymmetric returns or uncorrelated returns. That is to say that strategies which capture more upside than downside and strategies that deliver returns that are not dependent on the direction of the stock or bond market are where it could make sense to spend. These types of return streams generally cannot be replicated by making allocations into low-cost investments that provide market exposure.

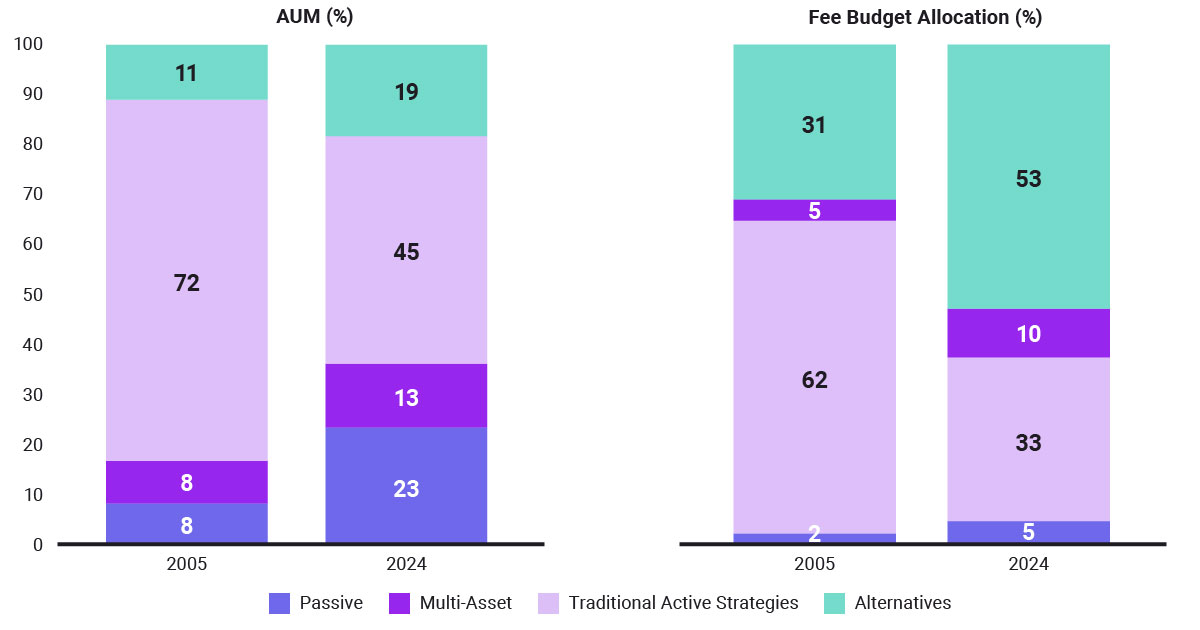

Capital and fee budget allocations are shifting

Two decades ago, 72% of capital was allocated into traditional long-only actively managed funds. Today, that share has declined to 45%. More and more of that capital is being redirected to a combination of passive investments and alternative strategies with 23% and 19% market share respectively. Similarly, we’ve seen the percentage of fee budget allocated to traditional long only funds decrease to 33% from 62% and the allocation to alternatives increase to 53% from 31%.

Source: Boston Consulting Group. Data as of Apr 2025. https://web-assets.bcg.com/cc/0a/25876ea740168e908a8652e147d7/2025-gam-report-april-2025.pdf

This shift isn’t a rejection of active management; it instead is a recognition that manager skill can be accessed more cost-effectively by unbundling market exposure from manager skill. Today, investors and advisors recognize that they can maximize value relative to cost in their portfolio by combining low-cost market exposures with high-value alternative strategies. The end result could be the potential to deliver more diversification and greater access to manager skill at a lower overall cost.

A useful analogy: The power of unbundling

This evolution mirrors changes in other parts of our lives, like the rise of streaming services and consumers opting out of cable television. Twenty years ago, you had to have a cable subscription to watch everything you wanted. That often meant subscribing to an expensive cable package that included hundreds of channels, even though you probably only wanted a handful of them. Today you don’t have to pay for channels you don’t want because streaming services allow you to select only the content you want and you can watch it whenever you want, at a fraction of the cost.

The investment industry has been evolving in a similar way. In the past, accessing manager skill generally meant buying a traditional mutual fund and paying active fees for the entire package—even if only a small portion was worth the premium. Now, investors can separate market exposure (via low-cost passive funds) from manager skill (via high-value alternatives), while aiming to achieve better outcomes at lower costs. It’s like the streaming model for investing.

Illustrating Fee Budgeting in action

Consider a traditional equity fund with a 1% management fee. From what we have seen in many funds, 90% of the risk and return comes from the market, and only 10% from active management. If market exposure can be obtained for just 5 basis points (e.g., via a passive index ETF), then 95 basis points are effectively being paid for manager skill, translating to a 9.5% fee for the actively managed part of the portfolio.

Now compare that to a more thoughtful way to spend your fee budget. An investor could achieve a similar outcome by having a portfolio investing 90% in a passive ETF that charges 5 basis points and 10% in a hedge fund charging a 1% management fee. The total management fee drops to just 0.15%, resulting in an 85% reduction in fees. If the hedge fund has a 20% performance fee, the portfolio would need to achieve a gross return of 43.5% before the total management fees and performance fees paid by the investor equalled the 1% management fee of the traditional fund.

Spending more on alpha, less on beta

Want to allocate even more of the portfolio to alpha potential? Using the same assumptions mentioned previously, a 70/30 split between low-cost market beta and high-value alternatives could triples the exposure to manager skill while still cutting management fees by two thirds to 0.33%. In this scenario, the investor still does not pay higher fees until the portfolio achieves a double-digit gross return.

This material has been published by PICTON Investments on September 9, 2025. It is provided as a general source of information, is subject to change without notification and should not be construed as investment advice. This material should not be relied upon for any investment decision and is not a recommendation, solicitation or offering of any security in any jurisdiction. The information contained in this material has been obtained from sources believed reliable, however, the accuracy and/or completeness of the information is not guaranteed by PICTON Investments, nor does PICTON Investments assume any responsibility or liability whatsoever. All investments involve risk and may lose value. This information is not intended to provide financial, investment, tax, legal or accounting advice specific to any person, and should not be relied upon in that regard. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional.

This material is intended for use by accredited investors or permitted clients in Canada only. Any review, re-transmission, dissemination or other use of this information by persons or entities other than the intended recipient is prohibited.