HOW YOUR ADVISOR IS DRIVING GREATER VALUE

WITH ALTERNATIVE INVESTMENT STRATEGIES THAT HELP TO OFFER GREATER CERTAINTY

Markets are more unpredictable and now, new regulations are changing how fees and value are communicated to investors like you. At PICTON Investments, we help advisors stay ahead of the curve by working with them to build smarter, more resilient portfolios that aim to deliver better value for their clients, beyond strong fund performance.

INVESTMENT FEE TRANSPARENCY AND WHY IT MATTERS TO YOU?

Starting in 2026, you will have greater transparency to your investment statements with a full breakdown of total dollar amount of fund expenses and direct investment fund charges for your investments, including:

• What your advisor earns for their advice and service

• What the fund company charges to manage your investment

• How those costs relate directly to your investment returns

This is designed to help you better understand the value you’re receiving and what you’re paying for.

THE VALUE OF PICTON INVESTMENTS

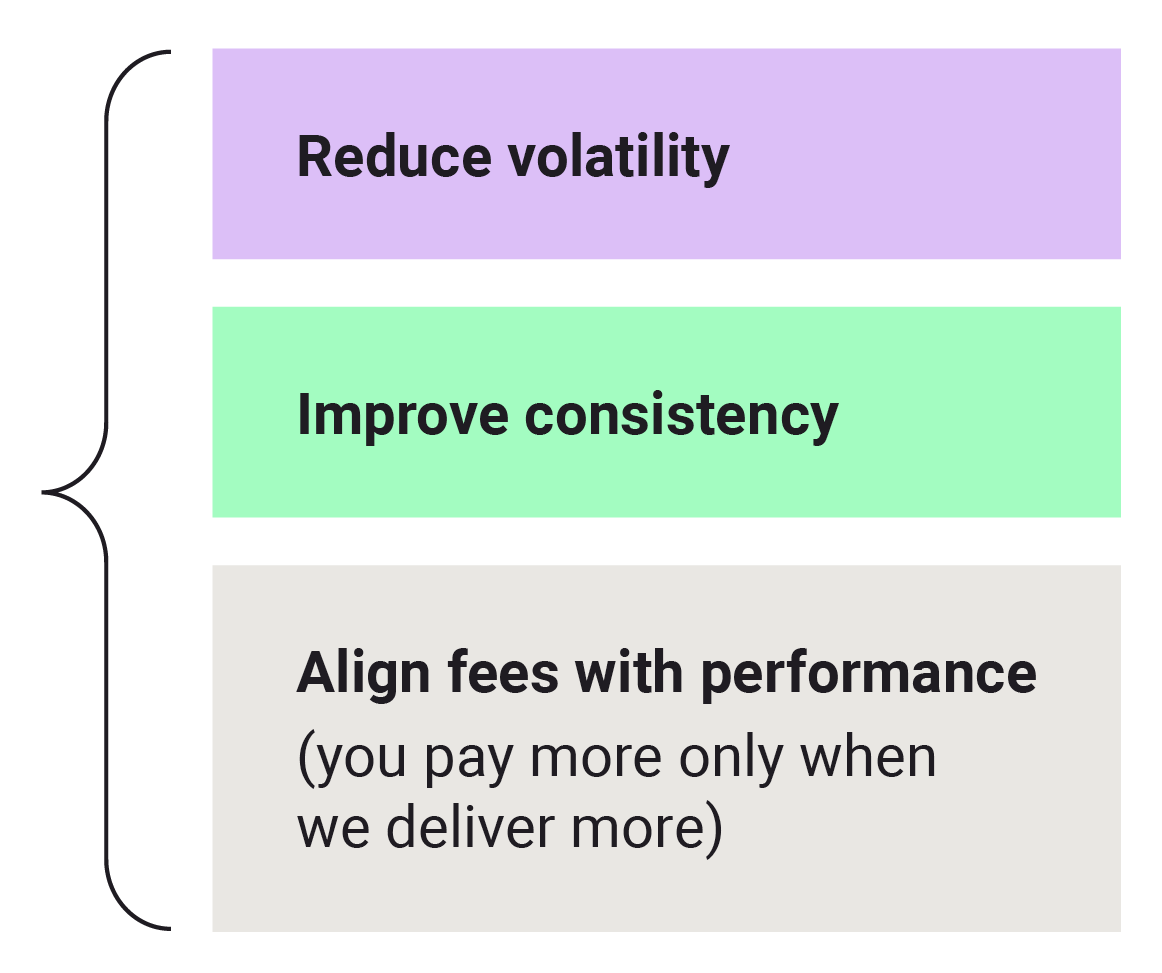

To help you get more out of every dollar, your advisor may use high-value alternative strategies from PICTON Investments which are designed to: These strategies aim to help you stay better protected in down markets, while still capturing meaningful upside when opportunities arise.

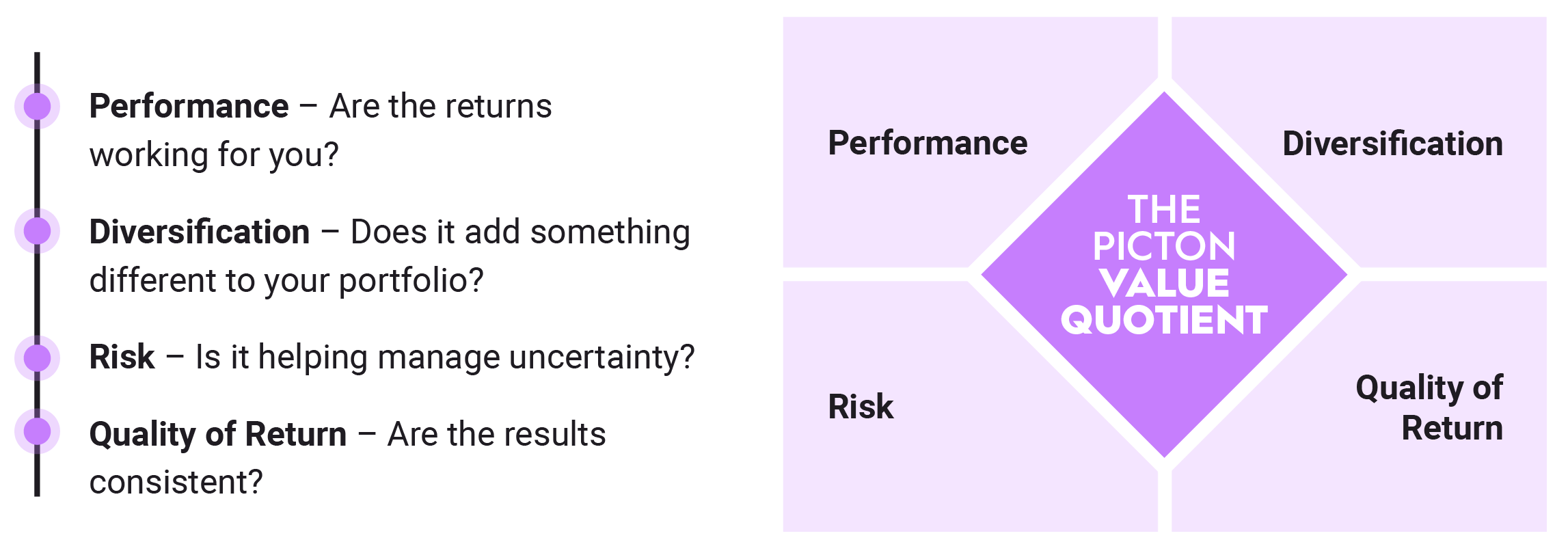

PICTON INVESTMENTS VALUE: BEYOND PERFORMANCE

When your advisor uses alternative strategies from PICTON Investments, investments may be selected not just based on returns, but on what truly matters to your long-term outcomes:

YOUR ADVISOR’S GUIDANCE IS UNBIASED AND BUILT FOR YOU

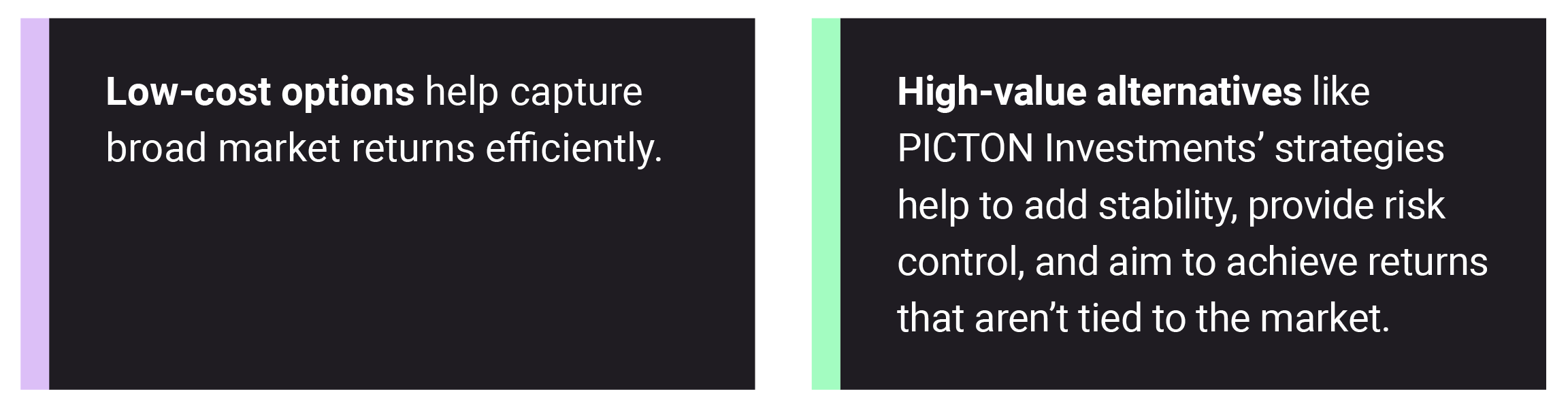

Your advisor isn’t paid or incentivized by the fund company, they’re focused on what’s right for you. That includes managing your overall fee budget wisely.

By combining both, your advisor could build a portfolio that’s not just diversified, but designed to perform better across market conditions

THE BOTTOM LINE:

In a world where you’ll soon see all the embedded fees on your statement, your advisor aims to ensure you will see the outcomes and value behind the fees you pay. That’s real alignment.

Disclosure

This material has been published by PICTON Investments on August 20, 2025. It is provided as a general source of information, is subject to change without notification and should not be construed as investment advice. This material should not be relied upon for any investment decision and is not a recommendation, solicitation or offering of any security in any jurisdiction. The information contained in this material has been obtained from sources believed reliable, however, the accuracy and/or completeness of the information is not guaranteed by PICTON Investments, nor does PICTON Investments assume any responsibility or liability whatsoever. All investments involve risk and may lose value. This information is not intended to provide financial, investment, tax, legal or accounting advice specific to any person, and should not be relied upon in that regard. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional.

Any review, re-transmission, dissemination or other use of this information by persons or entities other than the intended recipient is prohibited.